Taxpayer Assistance Centers operate by appointment. When you arrive, wear a mask and stay 6 feet away from others. Reschedule your appointment if you feel ill. To visit your local Taxpayer Assistance Center, you must: Find the office you need to visit. Make an appointment by calling the appointment number for that office. 367 reviews from Internal Revenue Service employees about working as a Customer Service Representative at Internal Revenue Service. Learn about Internal Revenue Service culture, salaries, benefits, work-life balance, management, job security, and more.

- Internal Revenue Customer Service Number

- Inter Revenue Service Phone Number

- How To Speak To Someone At Internal Revenue Service

Business and Corporate Customers

Need help with your business or corporate tax account? For the quickest service, visit our new online portal, INTIME, to send a secure message by selecting the “All Actions” tab followed by clicking on the “Messages” section.

You can also find information on filing and paying, setting up a payment plan, registering a business, closing a business, viewing balances due and requesting a refund.

An INTIME User Guide is available here.

Our phone lines are currently experiencing long wait times. If possible, use the INTIME messaging system above. If you must speak with customer service, you may call 317-232-2240, Monday through Friday, 8 a.m. – 4:30 p.m. EST.

We do not recommend contacting us by email if you need to include personal information to get your issue resolved. DO NOT include Social Security Number, date of birth or bank account numbers. Instead, use the INTIME messaging center to send secure messages. To do so, log in to INTIME and send your inquiry to DOR customer service by selecting the “All Actions” tab and then locating the “Messages” section. Click on “Send a message” and then follow the prompts to select the account for which you have questions and submit your inquiry.

Email addresses

Individual Income Tax Customers

Individual Income Tax Customers have several options to contact DOR. The easiest option is to email us directly. We do not recommend contacting us by email if you need to include personal information to get your issue resolved. DO NOT include Social Security Number, date of birth or bank account numbers

- If you need to mail us please check out our list of P.O. Boxes

Contact Us By Phone:

- Please note: we are currently experiencing long wait times, for the fastest service take advantage of our online services or contact us via the email above.

- Individual Income Tax: (317) 232-2240 Available 8 a.m. - 4:30 p.m. EST

- Filing your taxes, INfreefile, Refund status

- Payment Services: (317) 232-2240

- Refund or Collection/Liability Status (Automated): (317) 232-2240

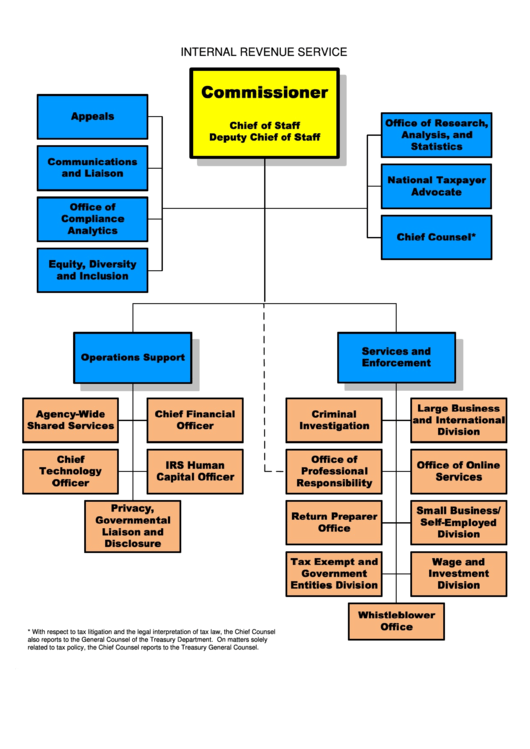

- Taxpayer Advocate Office:(317) 232-4692

- The TAO helps customers resolve issues that have not been settled through other DOR programs and is a final resource to resolve the issue.

Motor Carrier Services Customers

Motor Carrier Services Customers can contact this division at (317) 615-7200 or at the phone numbers and emails provided on this list. Appointments are required to open new IRP or IFTA accounts through Motor Carrier Services. Appointments are preferred but are not required for other in-person services.

All other DOR customer walk-in centers are open for in-person assistance. Appointments are highly recommended for reduced wait times.

By Mail

Request a DOR Speaker for Your Event

Request a virtual DOR speaker by filling out the Speaker Request Form.

Please email completed form to DOR's Business Outreach Program

Order Tax Forms and Publications

- By Phone: (317) 615-2581 → Leave order on voice mail, available 24 hours

/united-states-internal-revenue-tax-return-forms-1137415864-6ed9d056b14247c78f2234c450b6f554.jpg)

Receive Agency Announcements from DOR

Internal Revenue Customer Service Number

Sign Up Here.

Inter Revenue Service Phone Number

Other Areas Administered by DOR:

How To Speak To Someone At Internal Revenue Service

- Employment Agency Licensing: (317) 232-5977

- Letter of Good Standing: (317) 232-5977

- Motor Fuel Hotline: (317) 615-2630

- Report illegal users of dyed fuel

- Electronic Funds Transfer: (317) 232-5500

- Investigations: (317) 232-3376

- Warrant Division: (317) 232-2240

- Legal: (317) 232-2100

- Bankruptcy Section: (317) 232-2289